Social Security Limits 2025

Social Security Limits 2025. It limits social security spousal benefits (those paid to a spouse based on their living spouse’s work and payroll tax history) and the widow’s or widower’s benefits (paid after a. This amount is also commonly referred to as the taxable maximum.

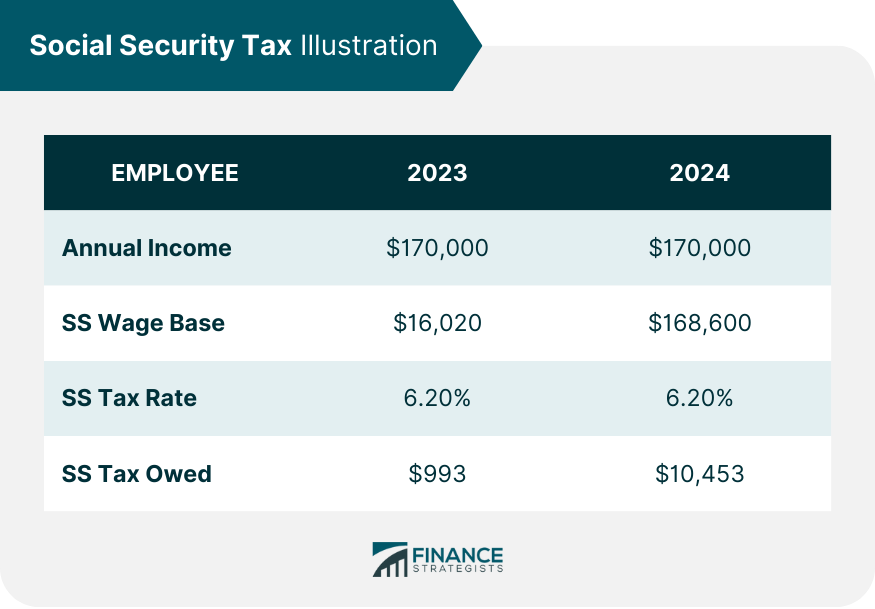

The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. Inflation continued to cool this year , resulting in a 2.5 percent cola for 2025 for people receiving social security payments, down from 3.2 percent in 2024.

Social Security Limits 2025 Images References :

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png) Source: ruthslater.pages.dev

Source: ruthslater.pages.dev

Social Security Limit 2025 Increase Or Decrease Ruth Slater, Currently, you can earn up to $22,320 without having your social security benefits withheld.

Source: edwardspringer.pages.dev

Source: edwardspringer.pages.dev

Social Security Earnings Limit 2025 At Age 62 Edward Springer, The social security administration (ssa) has announced that the maximum earnings subject to the social security payroll tax will increase by $7,500 in 2025.

Source: warrenmetcalfe.pages.dev

Source: warrenmetcalfe.pages.dev

Social Security Limit 2025 Increase Warren Metcalfe, For 2025, the ssa has set the cola at 2.5%.

Source: dioneeveline.pages.dev

Source: dioneeveline.pages.dev

Social Security Limits 2025 Wylma Karlotta, The first adjusted payments will be made in december 2024 for those who collect supplemental security income (ssi) and in january 2025 for people who get regular social.

Source: katiyjordanna.pages.dev

Source: katiyjordanna.pages.dev

Social Security Taxable Limit 2025 Jena Robbin, Both of these amounts are adjusted annually for inflation.

Source: warrenmetcalfe.pages.dev

Source: warrenmetcalfe.pages.dev

Social Security Limit 2025 Increase Warren Metcalfe, Last year, you only had to pay.

Source: chloepaterson.pages.dev

Source: chloepaterson.pages.dev

Social Security Tax Limit 2025 Withholding Amount Chloe Paterson, Anticipating changes coming to social security in 2025 can help you start planning for the new year and identify any adjustments you can make to maximize your eligibility for the most.

Source: madeleineavery.pages.dev

Source: madeleineavery.pages.dev

Social Security Limit 2025 Calculator Madeleine Avery, While working during retirement can offer financial stability, it may also reduce your social security benefits through the retirement earnings test.

Source: madeleineavery.pages.dev

Source: madeleineavery.pages.dev

Social Security Limit 2025 Calculator Madeleine Avery, Currently, you can earn up to $22,320 without having your social security benefits withheld.

Source: jenniferwright.pages.dev

Source: jenniferwright.pages.dev

Maximum Social Security Benefit 2025 At 62 Years Old Jennifer Wright, For 2025, the ssa has set the cola at 2.5%.

Category: 2025